𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐯𝐬. 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐆𝐫𝐨𝐮𝐩𝐬 𝐢𝐧 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠: 𝐖𝐡𝐢𝐜𝐡 𝐢𝐬 𝐁𝐞𝐭𝐭𝐞𝐫 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐂𝐚𝐫𝐞𝐞𝐫?

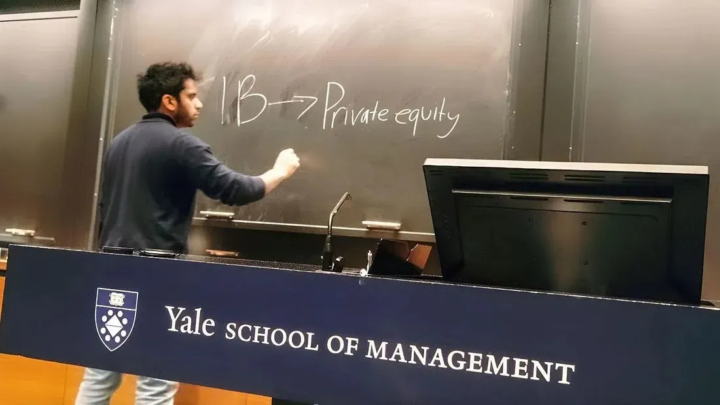

Choosing between product groups (M&A, ECM, DCM) and coverage groups (industry-focused teams) as a junior banker at Goldman Sachs or JPMorgan profoundly shapes your career. 𝐏𝐫𝐨𝐝𝐮𝐜𝐭 𝐆𝐫𝐨𝐮𝐩𝐬 (𝐃𝐞𝐚𝐥 𝐄𝐱𝐩𝐞𝐫𝐭𝐬) Specialise deeply in one deal type (e.g., mergers or IPOs), across multiple industries. • Pros: Technical excellence, intense financial modelling, deal structuring mastery. Ideal for roles at buy-side firms (private equity, hedge funds) demanding rigorous analytics. • Typical Day: Execute detailed financial models, valuation analyses, and deal negotiations. You become a technical expert (e.g., complex LBO modelling in LevFin). • Exit Opportunities: Highly favoured by mega-funds like KKR or Blackstone due to heavy transaction and modelling experience. 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞 𝐆𝐫𝐨𝐮𝐩𝐬 (𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐄𝐱𝐩𝐞𝐫𝐭𝐬) Focus deeply on one industry (e.g., TMT, Healthcare), across multiple deal types. • Pros: Deep sector expertise, earlier client interaction, broader strategic understanding. Excellent for sector-focused investing or corporate roles. • Typical Day: Industry research, operating models, client relationship management. You'll cover equity raises, debt financings, and M&A—all for one industry. • Exit Opportunities: Ideal for roles valuing industry expertise, such as sector-specific hedge funds, VC, or corporate strategy. 𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬 𝐭𝐨 𝐂𝐨𝐧𝐬𝐢𝐝𝐞𝐫: 1️⃣ Technical Skill Development: • Product: Intensive, specialised financial modelling (e.g., M&A valuations, LBO structures). • Coverage: Broader industry and strategic business insight, holistic financial analyses. 2️⃣ Client Interaction & Network Building: • Product: Intermittent, deal-specific interactions, technical specialist role. • Coverage: Frequent, ongoing client relationships, strong early network development. 3️⃣ Exit Opportunities: • Product: Clear path to PE (especially from M&A, LevFin). ECM/DCM is more challenging for PE but suitable for credit roles or hedge funds. • Coverage: Excellent for sector-focused funds (VC, growth equity, hedge funds), corporate roles, or industry-specific strategy positions.

0

0

𝐇𝐨𝐰 𝐆𝐨𝐥𝐝𝐦𝐚𝐧 𝐒𝐚𝐜𝐡𝐬 𝐒𝐜𝐫𝐞𝐞𝐧𝐬 𝐂𝐕𝐬 𝐢𝐧 15 𝐒𝐞𝐜𝐨𝐧𝐝𝐬

Recruiters in GS London process thousands of applications each cycle. They don’t read every line — they scan for impact: does each bullet show a clear action, measurable result, and relevance to the role? If not, it’s dismissed in seconds. 𝑻𝒉𝒂𝒕’𝒔 𝒘𝒉𝒆𝒓𝒆 𝒕𝒉𝒆 𝑽𝑻𝑴𝑹™ 𝑭𝒐𝒓𝒎𝒖𝒍𝒂 𝒄𝒐𝒎𝒆𝒔 𝒊𝒏: It helps turn vague descriptions into clear, evidence-based achievements. 𝑭𝒐𝒓 𝒆𝒙𝒂𝒎𝒑𝒍𝒆: "Worked on a deal” → “Drafted client memo on £250m cross-border acquisition, adopted in partner submission.” This shift allows recruiters to see proof, not fluff — and that often decides whether your application progresses. 𝐖𝐡𝐲 𝐢𝐭 𝐦𝐚𝐭𝐭𝐞𝐫𝐬 Recruiters rarely spend 10 minutes on a CV — they spend closer to 15 seconds. Without quantifiable outcomes, your experience risks being overlooked. 𝐊𝐞𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭 Your CV isn’t a diary of everything you’ve done — it’s a concise evidence sheet of why you’re ready for the role. Would your CV pass Goldman’s 15-second filter?

2

0

𝐇𝐨𝐰 𝐭𝐨 𝐀𝐧𝐬𝐰𝐞𝐫 "𝐖𝐡𝐲 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠?" – 𝐅𝐫𝐨𝐦 𝐚𝐧 𝐄𝐱-𝐆𝐨𝐥𝐝𝐦𝐚𝐧 𝐒𝐚𝐜𝐡𝐬 𝐑𝐞𝐜𝐫𝐮𝐢𝐭𝐞𝐫

In final-round Goldman Sachs or J.P. Morgan interviews, your answer to "Why Investment Banking?" is crucial. Having recruited extensively for top banks, here’s my proven framework to craft standout answers that secure offers: 𝐒𝐭𝐞𝐩 1: 𝐑𝐞𝐟𝐥𝐞𝐜𝐭 𝐨𝐧 𝐘𝐨𝐮𝐫 𝐏𝐞𝐫𝐬𝐨𝐧𝐚𝐥 “𝐖𝐡𝐲” Explain how your interest began (e.g., a finance competition), how it developed (internship or student fund), and the moment it solidified (e.g., summer analyst experience). Authenticity comes from showing genuine reflection and exposure—not generic motivation like salary. 𝐒𝐭𝐞𝐩 2: 𝐀𝐥𝐢𝐠𝐧 𝐰𝐢𝐭𝐡 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠’𝐬 𝐃𝐍𝐀 Match your motivations clearly to the role’s realities. Love financial analysis? Discuss your passion for modelling and valuation. Thrive under pressure? Highlight teamwork on intense deals. Prove you truly understand and desire this demanding career. 𝐒𝐭𝐞𝐩 3: 𝐔𝐬𝐞 𝐭𝐡𝐞 𝐏𝐄𝐀𝐋-3™ 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤 Structure answers clearly: • Point: Your primary motivation for banking. • Evidence: Specific experience demonstrating this motivation. • Analysis: What you learned or achieved, reinforcing your interest. • Link: Tie directly to the firm’s strengths and values. • Data: Quantify your impact (deal size, outcomes achieved). Example: “Leading my university’s investment fund sparked my interest in banking’s analytical rigour. During an internship at a boutique bank, I built DCF models for a £150M healthcare deal, refining valuations under pressure. This experience deepened my passion for complex financial analysis. That's why your firm’s leadership in healthcare M&A, like the £5B ABC-XYZ merger, strongly aligns with my ambitions.” 𝐒𝐭𝐞𝐩 4: 𝐂𝐨𝐧𝐜𝐢𝐬𝐞 & 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥—𝐒𝐓𝐀𝐑-3™ 𝐓𝐞𝐜𝐡𝐧𝐢𝐪𝐮𝐞 Briefly structure examples: • Situation/Task: Outline scenario concisely. • Action: Clearly state your role. • Result: Quantify your impact. • Reflect briefly: How this reinforced your banking interest. This tight format conveys rich, impactful stories quickly—essential for brief, memorable answers. 𝐒𝐭𝐞𝐩 5: 𝐌𝐚𝐬𝐭𝐞𝐫 𝐃𝐞𝐥𝐢𝐯𝐞𝐫𝐲—𝐆𝐫𝐚𝐯𝐢𝐭𝐲 𝐓𝐞𝐜𝐡𝐧𝐢𝐪𝐮𝐞

2

0

1-30 of 117

powered by

skool.com/city-careers-coach-8722

Offer-Engineering for elite careers (Corporate Law • IB • PE). Gate-by-gate templates + weekly live drills.

Evidence on file for all outcomes.

Suggested communities

Powered by