Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Memberships

Global Business Growth Club

Public • 1.5k • Free

5 contributions to Global Business Growth Club

ITIN Filing obligations

Will I have to file a 1040-NR if I’ve earned income through my llc through remote contracts for services ( non-ECI income)?

1

2

New comment Oct 18

How does the IRS distinguish between ECI and non-ECI funds?

Forgive me if this is a bit of a naive question, but as far the IRS is concerned all they see is what's reported on tax returns, so how do they actually tell/conclude that the funds being reported on the return is non-ECI and not taxable?

1

2

New comment Oct 21

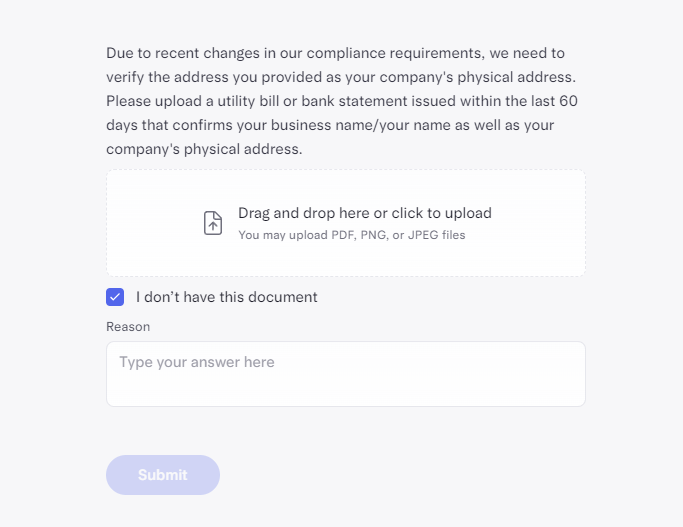

Mercury asking to verify LLC physical address.

Hi everyone, I'm opening a Mercury account for my LLC and after submitting all the documentation I just received an email asking for a utility bill or bank statement for my LLC (which I don't have at the moment). Does anyone have any tips on how to proceed in this case? UPDATE: I was approved after submitting a Wise bank statement with my LLC address.

4

10

New comment Oct 11

How to prepare 1065 form

I have a couple of questions regarding the form 1065. I have a multi member LLC ( both members foreign) that strictly makes money off of remote services provided to clients through contracts that are performed remotely. My questions are: 1. I know that the revenue the company’s making isn’t considered ECI, so do I note down no/zero earnings on the form? 2. Are there any attachments I also have to submit? ( Any schedules) 3. Do I have to stamp anything at the top? ( like how they write/stamp “FOREIGN OWNER DRE” at the top of 1120s for single member llcs for example)

1

1

New comment Oct 7

1040-NR

If I have an ITIN, am I required to report all my US Multi-Member LLC earnings on a 1040-NR every year? if so does that change my tax obligations ( considering I have no ECI)

2

2

New comment Aug 28

1-5 of 5