Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

39k members • Free

InvestCEO Boardroom

981 members • $2,500/y

954 contributions to InvestCEO with Kyle Henris

Merry Christmas and a Happy New Year!

I would like to wish everyone a prosperous new year! I am currently going through the lessons with a fine toothed comb not wanting to miss anything. I just set up tradeview, and I am learning how to set institutional supply and demand. I have a long way to go, but I will get there!

Feedback Requested

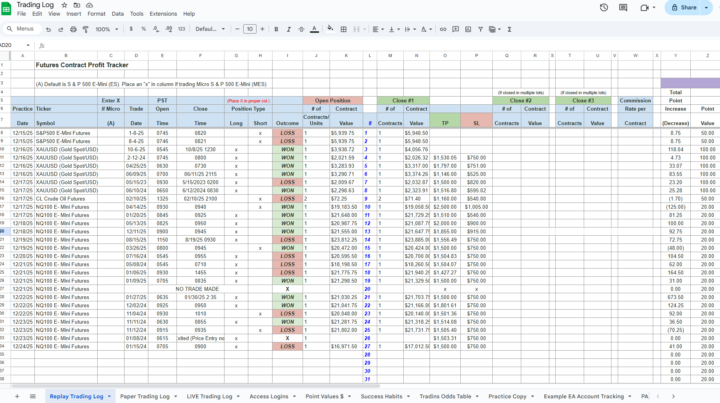

Hello everyone, I am currently practicing using Replay Trading on TradingView. Instead of using the “Select Bar” option, I choose a specific past date and set the chart to New York time so I do not unintentionally bias or cheat the process. I then follow all the steps Kyle has laid out, mark up my zones, and look for a proper trade entry. I make sure to log every trade so I can review my execution and decision making. Once I am comfortable and consistent with this, my next step will be live paper trading during the actual New York session, and after that, transitioning to live trading with a prop firm. I would appreciate any feedback on this approach and whether you have any suggestions for improvements. Thank You Merry Christmas!🎄

Newbie just joined

Hello everyone, I just joined. I'm glad to be part of this community and look forward to soaking up all the lessons.

Happy Holidays!!!

Happy Holidays to the group. As the year closes, I hope you all have the time to reflect on the things that you have in your life and take some time to feel thankful. I started my day trading journey in July. I set a goal to have one PA by the end of the year. Thanks to the concepts I’ve learned here, I just passed my 5th on Christmas Eve. Keep at this….you can do it!!! Take your time and go slowly….it will pay off. All my best to Kyle and Ryan and their families and to all of yours. Let’s get fired up for an awesome 2026!!!

Introduction

Hello Everyone Its Irtaqa here. I have been learning and trading for a few months now. This commnity really alignes with my Trading Goals. Hoping to get Real Knowledge and Insights from it. And would definitely pass it on in the future.

1-10 of 954

@mark-clarno-1860

Make time for mindset everyday!!!

.

Save $15 on a new user Tradingview account!

https://www.tradingview.com/black-friday/?share_your_love=markclarno

Active 11h ago

Joined Apr 1, 2024

California

Powered by