Welcome to the Business Opportunity Club.

Check out our Free Classes & Business Offerings:

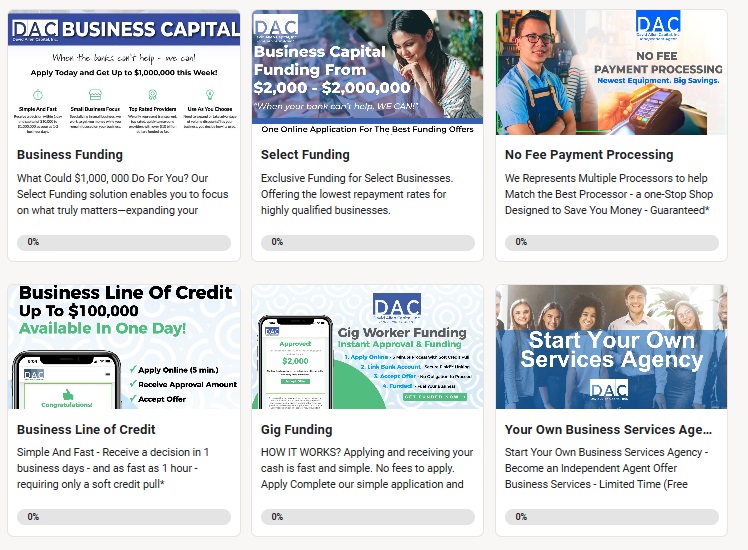

1) Start Your Own Agency - Business Services

2) Apply for a Business Loan

3) Apply for Zero Fee Payment Processing

4) Apply for a Business Line of Credit

5) Apply for Select Funding

6) Apply for Unlimited Prescriptionsi

7) Apply for Gig Funding (Self-Employed)

8) Apply for Healthcare (Individual and Group Policy's)

9) Launch a Fund - Learn about Opportunity Zones

skool.com/opportunity-zone-1349

Learn about Business Opportunities & Opportunity Zones

powered by