Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

Public • 21.1k • Free

8 contributions to InvestCEO with Kyle Henris

Private training? Automated software?

Good evening all! I'd really like to hit the ground running with this! I've noticed private training mentioned in some of the videos. I'd be interested to know more. I find learning more efficient when I can walk through the concepts with some live guidance to ensure I'm making the right decisions! Has anyone taken private lessons and what has your experience been? Has anyone used the automated software?

2

8

New comment 12h ago

Finished course #4 ! Questions!

Worked my way through lesson 4, and have a few questions. Superman Entry didn't click for me at all, but Jedi is more convenient given my 9-5 schedule. Can I just hone in on one entry style and leave it at that? How does this differ from trendline analysis? I was originally looking at Tori Trades' course but found that it was a little too oversimplified to grasp. I felt as if there was more that was necessary to learn. Regarding the blurb on funded account sizes in one of the videos and the recommendation to only have one account to start (no copiers), is it more advantageous to "go big or go home" in terms of account size? Provided you have the monthly $$ to start one? I.e., should I just go for the 300k account or stick to the 25k? the initial goal is income replacement (4k/month) but ideally 10k + or more would be better. is it more of a hassle to pass one account after another or just get a bigger one to begin with? is there data on the average amount of time students of this course took to pass an evaluation? how long did everyone paper trade before feeling confident to start an evaluation? Do we have resources for video conferencing where we can have someone watch our supply/demand block creation in real time and talk us through it? the videos are helpful but sometimes that extra support can't hurt! I want to have total confidence before starting an evaluation. Happy holidays everyone!

2

7

New comment 5h ago

1 like • 14h

or have them watch me do them and give me feedback. I'd like to start paper trading in the upcoming week. Question: when doing the evaluation accounts, is it doable to do 5 at once? can you start using a copier at that point or is it still recommended to do just one at first then scale as soon as you pass? I may be changing jobs soon I want to be efficient in how I use the income to invest in this venture.

Finished Course #3 and practicing drawing supply & demand boxes....

Hey all, still trying to fully understand the supply/demand boxes concept and learn the ropes of the TradingView software. I'm working off one small tablet with a detachable keyboard and no mouse or additional screen, so the efficiency of use could be better. After I had drawn 3 rectangles it got a bit glitchy so I drew the red one in after taking the screenshot. exactly where do we typically take entries/exits? at the top or bottom of the rectangle or anywhere within it? or do we cover that in lesson 4? I'm not quite sure if i'm at a good time frame in the below screenshot, or if the chart is too spread out to see things correctly. I'm seeing a lot of demand zones, but not a lot of institutional supply? The trend is definitely bullish and I don't see the trend get broken at all because the overall trend is still up. Am I getting the hang of it? I still feel that my grasp of the concept is fairly vague and wonder if I should rewatch some of the videos before advancing to lesson 4? would anyone be willing to provide their practice screenshots and talk through their logic with me while I get better at using TradingView? Thanks!

5

6

New comment 16h ago

12 Days of Christmas...Day 4 🎅

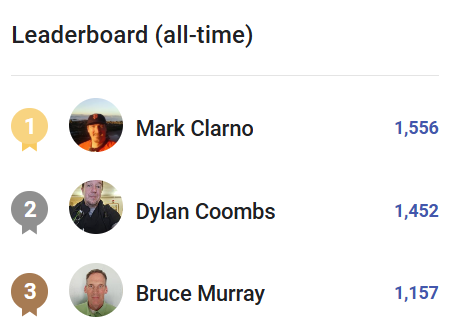

On this 4th Day of Christmas my gift will be... SCHOLARSHIPS!!! That's right this is a big one. For those that don't know I have automated trading software that a ton of hours and money have gone into developing. There's some exciting things going on with it in 2025, but for three people they'll be able to gain some access to it....FOR FREE. Those three people are none other than the Top 3 individuals on the leaderboard in this group: @Mark Clarno @Dylan Coombs @Bruce Murray I've mentioned several times that we notice those of you who are positive, active, and engaged here. This is me putting my money where my mouth is 🎁

97

67

New comment 2h ago

Course Outline Notes?

Is there a way we can have access to the course outline document that Kyle runs through in some of the videos? I definitely appreciate the downloadable PDFs but it would be helpful to have the outline as well. I like printing notes out and highlighting them as I follow along.

1

0

1-8 of 8

Active 3h ago

Joined Nov 27, 2024

Chicago

powered by