Activity

Mon

Wed

Fri

Sun

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

What is this?

Less

More

Owned by Gianluca

A community on Quantitative Finance, Investments, Portfolio Management and much more.

Memberships

Skool Community

Public • 182.4k • Paid

The Founders Club

Private • 37.6k • Free

Max Business School™

Public • 177.9k • Free

Software Developer Academy

Private • 20k • Free

Investire Semplicemente

Private • 496 • Free

Data Alchemy

Public • 22.3k • Free

34 contributions to Baglini Finance

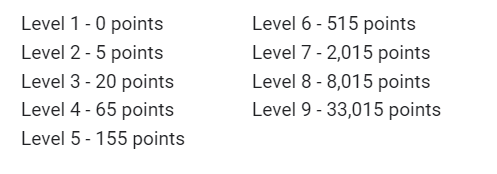

Important Communication - Give Away Investment Strategy - Level 3

I decided that I will give away one of my investment strategies to the first person who reaches Level 3. Also, I'll teach you exactly how it works and how to implement it yourself in a 1-to-1 call. Keep posting and interacting to make this community as engaging as possible!!

1

0

Free Webinar - Introduction to Python for Data Analysis

Hi all!! I was thinking that it would be cool to start a series of webinars to teach the basics of Python. I would like to make it very interactive in order to answer all you questions and doubts. As you may know, Python is one the most used languages in the world and knowing it is a great advantage for interviews, university projects or simply at work. At least, it was in my case!! LIKE THE POST IF YOU ARE INTERESTED!

5

4

New comment May 22

Interest rate planning cut by the Fed - What is the impact on the economy ?

Since December last year, the Fed has signaled it would expected to cut its key interest rate by the equivalent to three quarter-point cuts, from the current range of 5.25 to 5.5 per cent. Up until March, markets were betting that policymakers would make more cuts as inflation remained and growth slowed. What will be the impact of the interests rates cuts by the Fed on the economy ? - Increased Borrowing and Spending: Lower interest rates make borrowing cheaper for businesses and consumers. This often leads to increased borrowing for investments in business expansion, such as equipment purchases or infrastructure improvements, and for consumer spending on big-ticket items like homes and cars. This boost in spending can stimulate economic growth. - Stimulated Investment: Lower interest rates encourage businesses to invest more in projects that require borrowing. This can lead to increased capital spending, which can enhance productivity and innovation in the economy, ultimately driving long-term growth - Housing Market Activity: Lower interest rates tend to reduce mortgage rates, making homeownership more affordable. - Stock Market Response: Equity markets often respond positively to interest rate cuts, as lower rates can make stocks more attractive relative to fixed-income investments. This can lead to higher stock prices and increased investor confidence, which can further stimulate consumer spending and economic activity. - Weakened Currency: Lower interest rates can lead to a decrease in the value of the currency as well. - Impact on Savers: While borrowers benefit from lower interest rates, savers may see lower returns on their savings and investments, particularly in fixed-income assets like bonds and savings accounts. I would be happy to read some of your thoughts about the subject. Guillaume

2

2

New comment Apr 9

YTD TRADING VOLUME BY CRYPTO ON BINANCE

Continuing from yesterday's analysis, where we highlighted the year-to-date volume across multiple exchanges, today we look at how the trading volume of the main crypto has changed over the last months, specifically on the Binance exchange. Amidst the recent surge in excitement surrounding the introduction of spot Bitcoin ETFs, the year-to-date (YTD) dollar volume across centralized exchanges has surged to levels not witnessed since late 2021. Considering the top crypto by market cap, the daily trading volume in the Binance exchange peaked at $18 billion on March 6th, marking a substantial increase from the lows observed in early February, which hovered around $6.5 billion. Remarkably, daily exchange volume has surpassed this threshold for less than two months throughout its history, with the majority of this period occurring during the bullish trend of 2021 when Bitcoin initially soared to $69,000. While the surge in daily trading volume has been rapid in March, monthly trading volume has been steadily climbing over the past few months. Would like to replicate the analysis? Check the resources below: DataLab: https://lnkd.in/dxxYcHb9 Code available at: https://drive.google.com/drive/folders/10wWINUg1PtWl-nE27NRLkiZRIE_8sXjR?usp=drive_link Follow the page for more content! 🔔

1

0

CRYPTO VOLUME BREAKDOWN ACROSS EXCHANGES

Examining the distribution of trading volume across different exchanges offers intriguing insights into liquidity levels, user preferences, and prevailing market trends. When considering year-to-date (YTD) data analysis, several notable patterns emerge. Among the top crypto, Bitcoin consistently emerges as the dominant player, accounting for roughly 50-60% of trading volume across various exchanges. Following closely is Ethereum (ETH), typically capturing around 30% of the market share. However, what's particularly interesting is the higher variability observed among other cryptocurrencies. This variability underscores the diverse landscape of the cryptocurrency market, where certain assets may experience fluctuating levels of trading activity across different exchanges. Would like to replicate the analysis? Check the resources below: DataLab: https://lnkd.in/dxxYcHb9 Code available at: https://lnkd.in/dR7j56Qz Follow the page for more content! 🔔

0

0

1-10 of 34

@gianluca-baglini-9258

Investment Analyst - Data Scientist - Entrepreneurship

Active 112d ago

Joined Mar 9, 2024

Geneva, Switzerland

powered by