Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Daniel

Welcome to REALIST The Skool hub for Real Estate: Investors Realtors Mortgage Professionals Monthly FREE roundtables Upgrade for weekly calls!

Learn the fundamentals needed to build and scale a real estate portfolio. Create generational wealth and network with other investors / professionals.

Memberships

The Tribe

75 members • $9/month

Fasting Skool

638 members • Free

Listings Academy

452 members • $20/m

Aigent Academy

70 members • $47/m

Skoolers

188.6k members • Free

140 contributions to Real Estate Investing

Free Deal Analyzer just got a BIG upgrade

Still a work in progress but check it out in beta at https://realist.ca/ Would love to hear your thoughts & feedback! Spent a lot of time vibecoding this over the holidays and hope to continue doing so with your guidance. Dan

5

0

Free Deal Analyzer just got a BIG upgrade

Still a work in progress but check it out in beta at https://realist.ca/ would love to hear your thoughts & feedback! Dan

Buying Property in Other Countries // FREE Webinar // February's Realist Roundtable Expert

Add to your calendar: https://www.skool.com/realistgroup/calendar?calDate=1770504935&eid=1b404061df574648acff5daeca0091e1&eoid=1770049800 Canadian investors are thinking globally again — but moving money, managing taxes, and actually buying abroad is where things get complicated fast. That’s exactly what we’re breaking down at February’s Realist Roundtable. We’re joined by Cameron Hutchinson from Finseta, plus experts from three of the most popular global real estate markets, to walk through what actually matters when investing internationally. What we’ll cover: - 💸 Moving money across borders (FX, timing, fees, structuring) - 🧾 Tax considerations you need to think about before buying - 🏠 How buying property actually works in different countries (process, pitfalls, financing) - 🌐 Comparing markets Canadians are most curious about right now - ⚠️ Common mistakes people make when they go offshore too fast This is not a hype session. It’s a practical, investor-focused conversation for anyone thinking: “Should I be looking outside Canada — and if so, how do I do it properly?” 📅 Date: February 2 🎟️ Cost: Free for Realist members 📍 Where: Live Roundtable (registration link in calendar & above) If international real estate is even remotely on your 2026 radar, you’ll want to be in this room.

3

0

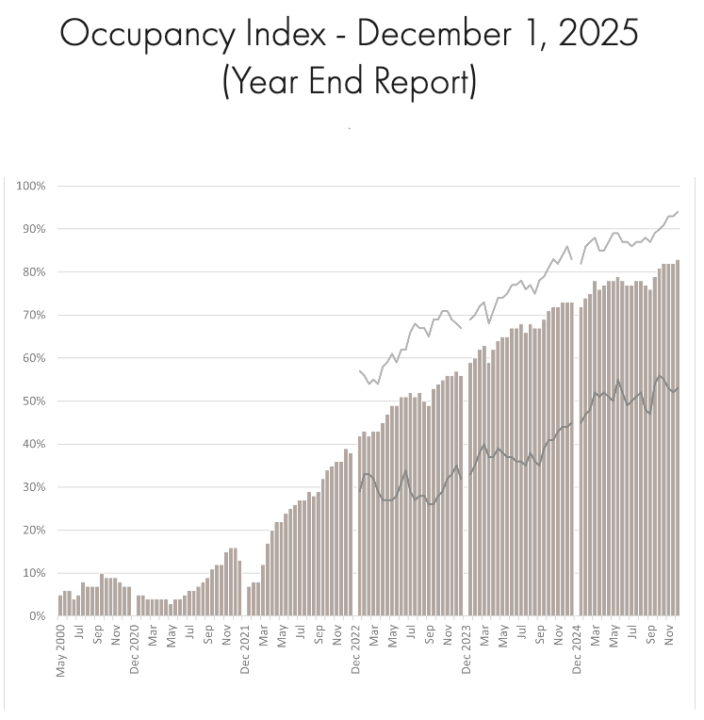

Toronto's Return to Office finished the year with another new record

Toronto's Return to Office finished the year with another new record Average weekly - 83% Peak Day - Wednesday 94% Low Day - Friday 53%

3

0

Multiplex workshop in Vancouver

Hi Nick I heard in your recent podcast there will be a workshop on multiplex in vancouver in April 2026. How can I join?

1-10 of 140

@daniel-foch-7694

1/2 of the Canadian Real Estate Investor Podcast. Real Estate Broker. Financier. Investor.

Active 1h ago

Joined Dec 20, 2023

Powered by