Activity

Mon

Wed

Fri

Sun

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

63 contributions to Generational Wealth Trading

9/15/24: +$8.4k at Market Open

Make sure your SI long position sold for +$4.2k per contract

0

15

New comment 3d ago

Adjustable Mini Contract Size Update

You can trade up to 100 contracts per algo on sim now! Download the newest ELD file in the classroom. Live trading accounts contracts per algo are limited based on your license.

1

4

New comment 6d ago

How to improve monitoring for technical issues

It sounds like the potential technical issues are a concern for many of us. I've been putting together some personal monitoring solutions today that I wanted to share with all of you. It's kind of duct taped together, but I think it'll reduce some of the stress around running the algos. I'm going to cover things at a high level, and we can get into details in the comments for anyone that wants some help. 1. First, check out @Kevin Gong's video on adding email alerts to TradeStation when there's a disconnection: https://www.youtube.com/watch?v=BaJd1hKl4YY 2. I set up an account with an alerting service. It can create special email addresses that I can send alerts to. There's also a mobile app that can page you with critical push notifications, which will override any "do not disturb" settings. 3. I wrote an AutoHotkey script that will detect when the "Strategy Automation Warning" dialog pops up and send an email. It will only send if I haven't been at the computer for at least 3 seconds so it doesn't alert while I'm toggling charts. 4. To detect whether my internet works, I set up another account with an online service for monitoring service health. I have another AutoHotkey script that will regularly make a request to the service to let it know my internet is up. Otherwise, the service will send an email alert to my alerting service. Although these are proactive alerts for keeping the system healthy, the last line of defense would be knowing when positions are not matching. I haven't figured out a good way to do that yet, but I'm hoping all of the above is going to be enough to prevent any issues already. I'm using ZenDuty.com for alerting and healthchecks.io for the internet uptime monitoring, but any similar alternatives will work! Edit: Adding links to Kevin's video and some docs going over the process 1. Set up TradeStation email alerts 2. Set up ZenDuty 3. Set up "Strategy Automation Warning" alerts 4. Set up internet connection health check

2

38

New comment 7d ago

1 like • 7d

If anyone is using an Outlook email for alerts, it looks like Microsoft will disable email and password authentication via SMTP on September 16. I haven't looked into what the alternative solution for Outlook is and just switched over to using a Gmail app password. Remember to also change the SMTP server in the script!

Put Kevin's Algos to the Test (Sep 9th, 2024)

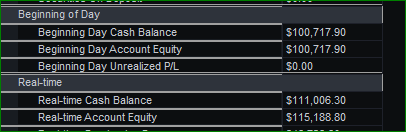

Market is closed. In the green for today. Let's see what happens tomorrow. 👍 ~ +10.3% Today ~ +11% Overall

1

16

New comment 10d ago

How do you trade a strategy, if you don't even know why the rules work?

The more obvious the edge, the more other traders dilute the edge. Therefore if you can understand why your strategy works, there is likely no edge. Or if there is, it will rapidly decay. This is why I only trade systematic data mined "black box" algos The "black box" is a feature not a bug. It's the moat that keeps out the competition from stealing your profits. Inspired by my tweet

2

11

New comment 21d ago

4 likes • 21d

I'll offer there are lots of reasons that known edges can persist. They can be too big to contain and likely too noisy to be worth allocating that much capital into. The flows effects in treasuries you helped investigate are prime examples of that. Carry trades are also a large inefficiency that come with severe drawbacks like we saw at the beginning of the month. Edges being noisy is probably the main reason they can persist. Trend following continues to work on long time horizons even though it can really suck in the medium term. Short volatility is another category of trading that continue to exist because poor risk management can destroy your capital if you're not careful. There's also edges where retail just can't compete due to capital and infrastructure constraints. All that said, I agree with your point that having "black box" algos is a feature, especially when you have a large diversified set of them. The potential growth in known edges for retail like those I listed above is still limited.

2 likes • 21d

@Cainan Shinjo My plan is to continue diversifying outside of the algos, even at the cost of possibly reduced growth. If I get to $1 million gained from these algos, that's likely going to make up a majority of my net worth. Putting that all in the algos is a higher allocation than I'd personally want. Even if you aren't trading more strategies on your own, that sort of money opens doors to investing in funds not accessible to most people.

1-10 of 63