Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

Public • 21.2k • Free

272 contributions to InvestCEO with Kyle Henris

Promo for funded account.

Hello and happy new year! I want to share this promotion for a funded account that I got on my email recently, hopefully to help someone, and also to ask if anyone has had any experience with this company and if there is some useful insights. Cheers to all and this 2025 better be ready for us!!!

2

3

New comment 16h ago

Strategy

Hello, what's your thoughts on sticking to one particular strategy? Whether it's working or not

6

13

New comment 14h ago

0 likes • 17h

Depends on the stratagy, and how long you quantify "sticking with it" for. You need to back test a stratagy so you know what the approximate win percentage is before going live with it so that you know what your risk to reward needs to be set at to make it profitable in the long run, and what your expectations should be for wins vs losses. Most any stratgy can be successful a certain amount of the time, even guessing is successful a certain percentage of the time, but you should understand your stratagy and it's probabilities of success on a long timeline of trades before going live. Don't risk real capital trying to figure out if a stratagy works or not. I'd say pick just one stratagy, and just one ticker, and practice it till it becomes second nature and you can execute without putting a lot of thought into it. Typically the stratagy is not to be blamed, but rather the user is where the errors lie.

Should you use only 1 lower TF for all your Superman trades?

Should we stick with 1 particular lower TF when looking for Superman entries? For example if I don’t like the chances of price coming back into my entry point on the 1 minute TF, but looks more promising on the 3 minute TF, AND (very important and) all my other.criteria is still met, is there anything wrong with switching to the 3 minute TF? Is this a bad habit to get into? I see the potential for this to turn into to chasing price, but, if I make sure all the normal entry criteria is met, are there down sides to this I’m not thinking of?

5

6

New comment 18h ago

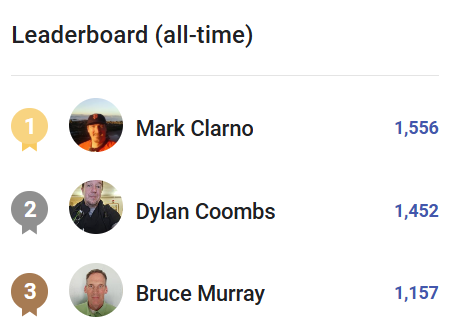

12 Days of Christmas...Day 4 🎅

On this 4th Day of Christmas my gift will be... SCHOLARSHIPS!!! That's right this is a big one. For those that don't know I have automated trading software that a ton of hours and money have gone into developing. There's some exciting things going on with it in 2025, but for three people they'll be able to gain some access to it....FOR FREE. Those three people are none other than the Top 3 individuals on the leaderboard in this group: @Mark Clarno @Dylan Coombs @Bruce Murray I've mentioned several times that we notice those of you who are positive, active, and engaged here. This is me putting my money where my mouth is 🎁

132

82

New comment 2d ago

1-10 of 272

@dylan-coombs-5505

Been trading for 6 years now. Mostly 0DTE options on SPY and QQQ. Big fan of Richard D Wycoff and volume spread analysis.

Active 3h ago

Joined Feb 10, 2024

powered by