Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

InvestCEO with Kyle Henris

40k members • Free

InvestCEO Boardroom

957 members • $2,500/y

1048 contributions to InvestCEO with Kyle Henris

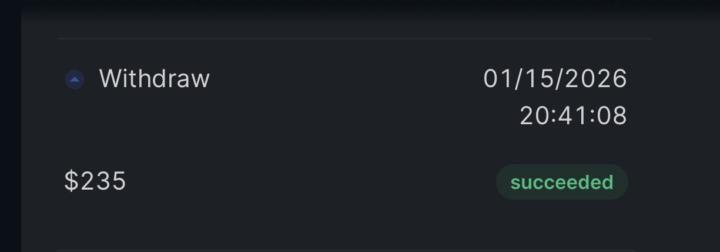

Finally got paid!

After a year plus of trying, I finally received my first payout. Isn’t much but it’s a start. Up from here.

Finally Passed!

For what it's worth, I was up and down with ES and MES. I was patient, but what worked for me was moving to SIL. Kyle, and Co., THANK YOU! Regardless of the chart, it was the strategies I learned from you.

Apex 30 percent t

Hi all I recently passed and recieved a 100k apex account . I am trying to do daily dollar amounts to stay under the consistency rule. With a 100k account if I did 250 or 500 a day that would stay under the consistency rule correct? Or would i have to have larger amount days since the account is 100k?

Takeaway from 5 Day Workshop

I want to say thank you to Kyle and his 5 day workshop in December, my big takeaway was Prop firms and the possibility and I have successfully passed my 1st evaluation for 25K. Now I really need to get to work and learn how not to blow it up. Thank You Kyle! ******Thank You all for your responses also, this an amazing group. It goes to show that it starts from the top down. And FYI I have not destroyed my funded account as of today. *****

💰 Monday Money Memo - 2025 Review

The Year in One Sentence… “2025 was the year markets rewarded adaptability — and punished anyone who assumed the old playbook still worked.” If you were flexible, selective, and patient → you probably did well. If you chased narratives without respecting price → the market reminded you who’s in charge. ✅ 2025 Market Recap (The Big Picture) Stocks - Large-cap tech and AI-linked names dominated headlines again — but this year came with more pullbacks, more skepticism, and more “prove it” moments. - Indexes finished strong overall, but returns were uneven. A few names did the heavy lifting. Many stocks went nowhere. 💡 Key lesson: Indexes going up ≠ most people making money. Crypto - Bitcoin spent much of the year consolidating, frustrating both bulls and bears. - Institutional interest quietly increased, even while price action stayed boring. 💡Key lesson: Boring accumulation phases are where future volatility is born. ✅ What Actually Mattered in 2025 (Not the Noise) 🤖 AI Grew Up 2025 was the year AI stopped being a buzzword and started being a business conversation. Markets moved from “AI will change everything” to: ➡️ Who’s profitable? Who’s spending too much? Who actually wins? Why this matters: The easy money phase is over. The selective money phase has begun. 🏦 The Fed Lost Its Scare Power Rates still mattered — but they didn’t dominate every single week like prior years. Markets learned to live with uncertainty instead of waiting for perfect clarity. Why this matters: The market doesn’t need certainty to move. It needs direction. 💰 Liquidity Was the Real Driver When liquidity expanded → risk assets breathed. When liquidity tightened → volatility snapped back fast. Why this matters: Narratives follow liquidity. Always. ✅ The Biggest Mistakes Traders Made in 2025 ❌ Overtrading chop So many accounts died not from big losses — but from death by boredom. ❌ Confusing conviction with stubbornness Holding losers “because the thesis is right” was expensive.

1-10 of 1,048

@bruce-murray-7356

I'm a husband and father of four living in Tennessee. I drive a truck for work and I'm eager to park that truck for good! Very grateful to be here!

Active 17h ago

Joined May 14, 2024

Powered by